Many people working in mutual banks and credit unions today would know of CUSCAL but what about CUFSAL? CUFSAL is an acronym for Credit Union Financial Services Australia Limited and was created in 1985 by the Australian Federation of Credit Union Leagues (AFCUL).

It was established as a national presence for credit unions in the Australian and international money markets and to improve security for credit union depositors. According to foundation Managing Director, Reg Elliott, CUFSAL had its origins about 5 years before its official commencement when the ‘central bank’ of the various state credit union associations began to integrate.

Historically, ‘central banking’ was necessary as credit unions need sufficient economies of scale in order to maintain the financial security of their operations and of course there is legislation overseeing this. When technology improved and legislation became increasingly federalised it made sense to create a national ‘central bank’ for credit unions. Eventually, the various state leagues became centralised in CUSCAL which also became the holding company for CUFSAL.

Greg Stevens was Executive Manager, Central Banking, with CUFSAL for over 10 years, leaving in 1994, (currently Chair of the Australian Credit Union Archives Trust) and wrote the following about CUFSAL for a Masters project in 1991:

CUFSAL is owned by and represents the state associations of NSW, ACT, South Australia (NT via South Australia) and Western Australia. In addition AFCUL has a small shareholding. CUFSAL’s Charter was to enhance the credit union movement by improving liquidity, guaranteeing settlement obligations and providing a treasury management function.

It was established with an innovative capital requirement which required each member state association that invested in the company that at all times it would maintain a debt to equity ratio of 20:1. Under CUFSAL’s Charter, each state association must continually upgrade their capital in accordance with the amount of funds they invest with CUFSAL.

Additionally, credit unions are required under their various statutes, to hold between 7% and 10% of deposits (depending on state legislation) in liquid funds. The majority of these funds are invested with CUFSAL through their state associations.

In 1992, after the implementation of Project Renewal, all CUSCAL’s shareholding credit unions deposited funds directly with CUFSAL.

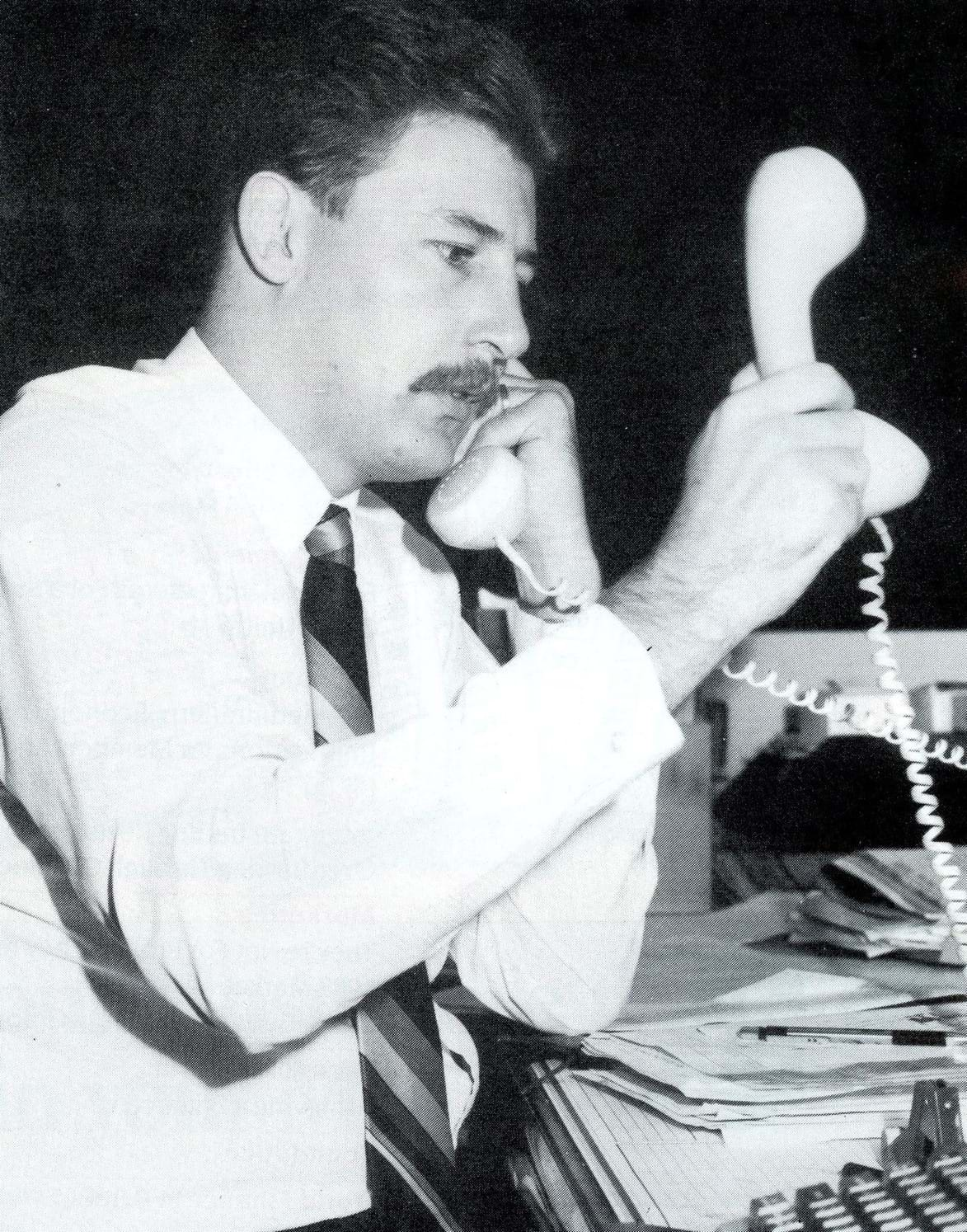

Part of Greg’s work with CUFSAL involved investing funds in the short term money market and fixed interest markets on behalf of investing associations (he is pictured below on the phones during a hectic trading day). The June 1987 edition of Australian Credit Unions Magazine included a feature on CUFSAL that incorporated a run-down of a typical day in the office for Greg. At one point after making a $5 million deal in securities over the phone, Greg says:

Quick thinking is the name of the game. You’ve got to be accurate – particularly when you’re number crunching. Those figures have to fall on the right side of the cash flow – that is, inflow or outflow of funds – or we’ll find ourselves in the black or the red just when we shouldn’t be.

CUFSAL was also responsible for handling the payments of the credit union movement’s Redicard and Visa payments from 1991 – as well as managing corporate and member chequing and national credit union superannuation funds.

Under the Financial Institutions Scheme, CUSCAL and CUFSAL were registered as Special Service Providers. In early 1994, CUFSAL was managing $2.5 billion in funds including national credit union cash and fixed interest ADFI’s and superannuation funds.

As time went on and credit unions became regulated by the Banking Act and became larger institutions, they didn’t require central banking for liquidity management. Today, CUSCAL provides payment services.

From Australian Credit Unions Magazine, June 1987